Aerospace giant Northrop Grumman will acquire Orbital ATK for approximately $9.2 billion, in a deal the companies announced Monday and they say will “expand capability” is largely “complementary” and involves “little overlap.”

Orbital ATK specializes in a wide variety of launch vehicles, satellites, missiles and munitions that Northrop believes will significantly enhance capabilities it lacks while offering Orbital significantly more technical and financial resources to grow sales and business opportunities.

Under the terms of the huge deal West Falls Church, Virginia based Northrop will dole out approximately $7.8 billion in cash to buy Dulles, Virginia based Orbital ATK and assume $1.4 billion in net debt. Orbital ATK shareholders will receive all-cash consideration of $134.50 per share, which is about a 20% premium above the stock’s price of $110 per share at the close of trading Friday, Sept. 15.

Rumors of the deal first appeared on Sunday.

The final purchase is expected to take place around mid-2018, subject to approval by government regulators and Orbital ATK shareholders.

The Boards of Directors of both companies have already given unanimous approval to the mega buyout.

“Our two companies represent a very complementary fit,” Wes Bush, chief executive officer and president of Northrop Grumman said in a conference call on Monday, Sept. 18.

“We have very little overlap, and we fully expect our combined portfolios of leading technologies, along with our aligned and innovation-focused cultures, to yield significant value creation through revenue, cost and operational synergies, accelerating our profitable growth trajectory.”

Northrop indicated that Orbital ATK will operate as a separate fourth unit – at least initially – and that Orbital programs will benefit from the increased financial resources available from Northrup.

“Upon completion of the acquisition, Northrop Grumman plans to establish Orbital ATK as a new, fourth business sector to ensure a strong focus on operating performance and a smooth transition into Northrop Grumman.”

For his part Orbital ATK CEO David Thompson was very pleased with the buyout and future opportunities.

“The agreement reflects the tremendous value that Orbital ATK has created for our customers, our shareholders and our employees,” David Thompson, Orbital ATK president and chief executive officer said at the conference call.

“The combination will allow our team as a new business sector within Northrop Grumman to maintain strong operational performance on existing customer programs and to pursue new opportunities that require greater technical and financial resources than we currently possess.”

“Our collective customers should benefit from the expanded capabilities for innovation, increased speed of delivery and improved affordability of production resulting from the combination.”

“The combination of our companies and human capital will also significantly benefit our customers,” Bush elaborated. “Together, we can offer our customers enhanced mission capabilities and more competitive offerings in areas such as space, missiles and strategic deterrents.

“Our shareholders can expect revenue synergies from these new business opportunities.”

Northrop Grumman sales for 2017 amount to about $25 billion vs. about $4.5 billion for Orbital ATK

Orbital ATK itself is the product of a very recent merger in 2015 of Orbital Sciences and ATK.

The company employs over 13,000 people including over 4,200 scientists and engineers. It holds a heft backlog of contracts worth more than $15 billion.

Northrop Grumman employs over 68,000 people and is the fifth largest defense contractor.

“The agreement will also provide expanded career options for our employees as part of a larger, more diverse aerospace and defense company,” said Thompson.

It will also benefit stockholders.

“The transaction represents a truly compelling financial proposition for our shareholders, valuing the enterprise at about $9.2 billion and providing our investors with more than 120% total return over the 3-year period from the completion of the Orbital ATK merger in early 2015 to the expected closing in the first half of 2018.”

Orbital ATK launchers run the gamut from small to medium to large.

The rockets include the massive solid rocket boosters for NASA’s Space Launch System (SLS) heavy lift rocket under development, the Antares liquid fueled booster used to launch Cygnus cargo freighters to the International Space Station for NASA, the Minotaur family of medium class solid rocket launchers, as well as sounding rockets for a variety of low weight science missions.

The most recent Orbital ATK launch took place on Aug. 26 when a Minotaur 4 rocket (a retired Peacekeeper ICBM) lifted off from Cape Canaveral with a USAF surveillance satellite.

Orbital ATK also has a thriving satellite manufacturing business building NASA science, commercial, government and military satellites.

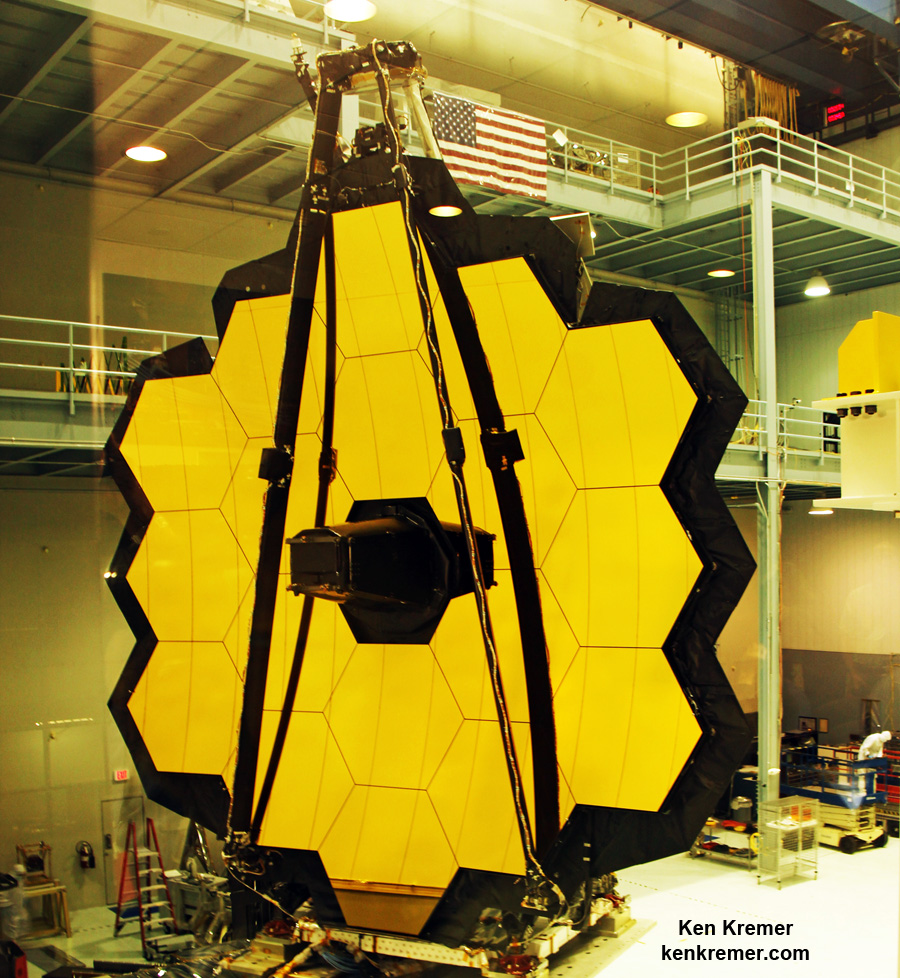

Northrop Grumman is the prime contractor for NASA’s James Webb Space Telescope and designed the optics and spacecraft bus under contract for NASA’s Goddard Space Flight Center in Greenbelt, Maryland.

The purchase is also estimated to result in $150 million in annual cost savings by 2020.

“We believe that this combination represents a compelling value creation opportunity for the customers, shareholders and employees of both our companies,” stated Bush. “Through our combination, all of our stakeholders will benefit from expanded capabilities, accelerated innovation and greater competitiveness in critical global security domains.”

Watch for Ken’s continuing onsite NASA mission and launch reports direct from the Kennedy Space Center, and Cape Canaveral Air Force Station, Florida, and NASA Wallops Flight Facility, Va.

Stay tuned here for Ken’s continuing Earth and Planetary science and human spaceflight news.